It was announced last summer that total student loan debt, at $830 billion, now exceeds total US credit card debt, itself bloated to the bubble level of $827 billion. And student loan debt is growing at the rate of $90 billion a year.

There are far fewer students than there are credit card holders. Could there be a student debt bubble at a time when college graduates' jobs and earnings prospects are as gloomy as they have been at any time since the Great Depression?

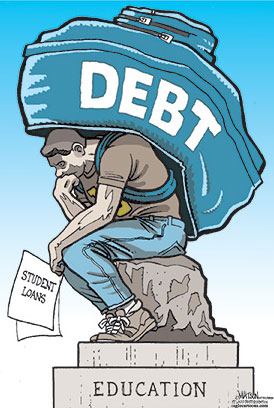

The data indicate that today's students are saddled with a burden similar to the one currently borne by their parents. Most of these parents have experienced decades of stagnating wages, and have only one asset, home equity. The housing meltdown has caused that resource either to disappear or to turn into a punishing debt load. The younger generation too appears to have mortgaged its future earnings in the form of student loan debt.

The most recent complete statistics cover 2 008, when debt was held by 62 % of students from public universities, 72 % from private nonprofit schools, and a whopping 96 % from private for-profit ("proprietary") schools.

For-profit school enrollment is growing faster than enrollment at public schools, and a growing percentage of students attending for-profit schools represent holders of debt likely to default. In order to get a better handle on the dynamics of student debt growth, it is helpful to sketch the connection between the current crisis in public education and the recent rapid growth of the for-profits.

Crisis of Public Education Precipitates Private School Growth

Since the most common advise to the unemployed is to "get a college education", and tuition at public institutions is at least half or less than private-school rates, public higher education institutions have been swamped with an influx of out of work adults. This has resulted in enrollment gluts a t many state colleges. At the same time, tuition is increasing just when household income and hence the affordability of higher education are declining.

Here is how this scenario unfolds:

With few exceptions, state-funded colleges and universities set tuition rates based on policy and budget decisions made by state legislatures. High and increasing unemployment and declining wages have resulted in declining public revenues. This in turn leads to budget cut directives from legislative bodies to public higher education institutions, often accompanied by the authority to increase tuition.

For example, a 14% budget cut to an institution may be "offset" by giving the governing boards of the school the authority to raise tuition by a maximum of 7%. Often the imbalance created by a cut to the base budget and an increase in tuition is made worse by limits on enrollment. A state legislative body may cut an institution's budget, allow it to increase tuition, but not provide per-student funding increases to keep pace with the accelerating enrollment demand.

This affects tuition rates at for-profit institutions. More students who would otherwise attend a state institution or a private, non-profit school are finding themselves without a seat at over-enrolled campuses. More students are pushed into the online and for-profit sectors, and proprietary schools sieze the day by inflating their tuition costs.

Because online colleges lack the enrollment constraints of a physical campus, they are uniquely poised to capture huge proportions of the growing higher education market by starting classes in non-traditional intervals (the University of Phoenix, for example, begins its online classes on a 5-week rolling basis) and without regard to space, charging ever-increasing rates to students who have no other choice.

Instead of waiting for an admissions decision or a financial aid package from a tr aditional college, students can enroll immediately online. This ease of use and accessibility to any student has allowed the for-profit sector to capture a growing portion of the higher education market and a growing proportion of education-targeted public money. Enrollments at for-profit colleges have increased in the last ten years by 225%, far outpacing public institution increases.

Thus, the neoliberal assault on public education not only tends to push more students into private institutions, it also generates upward pressure on tuition costs. This results in growing pressure on enrollees at proprietary schools to take on student loan debt.

How Healthy Are Student Loans?

The extraordinary growth of student debt paralleled the bubble years, from the beginnings of the dot.com bubble in the mid-1990s to the bursting of the housing bubble. From 1994 to 2008, average debt levels for graduating seniors more than doubled to $ 23,200, according to The Student Loan Project, a nonprofit research and policy organization. More than 10 percent of those completing their bachelor's degree are now saddled with over $40,000 in debt.

Are student loans as financially problematic as the junk mortgage securities still held by the biggest banks? That depends on how those loans were rated and the ability of the borrower to repay.

In the build-up to the housing crisis, the major ratings agencies used by the biggest banks gave high ratings to mortgage-backed securities that were in fact toxic. A similar pattern is evident in student loans.

The health of student loans is officially assessed by the "cohort-default rate," a supposedly reliable predictor of the likelihood that borrowers will default. But the cohort-default rate only measures the rate of defaults during the first two years of repayment. Defaults that occur after two years are not tracked by the Department of Education for institutional financial aid eligibility. Nor do government loans require credit checks or other types of regard for whether a student will be able to repay the loans.

There is about $830 billion in total outstanding federal and private student-loan debt. Only 40% of that debt is actively being repaid. The rest is in default, or in deferment (when a student requests temporary postponement of payment because of economic hardship), which means payments and interest are halted, or in forbearance. Interest on government loans is suspended during deferment, but continues to accrue on private loans.

As tuitions increase, loan amounts increase; private loan interest rates have reached highs of 20%. Add that to a deeply troubled economy and dismal job market, and we have the full trappings of a major bubble. As it goes with contemporary bubbles, when the loans go into default, taxpayers will be forced to pick up the tab, since just about all loans to date are backed by the federal government.

Of course the usual suspects are among the top private lenders: Citigroup, Wells Fargo and JP Morgan-Chase.

Financial Aid and the Federal Tilt to Private Schools

A higher percentage of students enrolled at private, for-profit ("proprietary") schools hold education debt (96 %) than students at public colleges and universities or students attending private non-profits.

Two out of every five students enrolled at proprietary schools are in default on their education loans 15 years after the loans were issued.

In spite of this high extended default rate, for-profit colleges are in no danger of losing their access to federal financial aid because, as we have seen, the Department of Education does not record defaults after the first two years of repayment.

Nor have the disturbing findings of recent Congressional hearings on the recruitment techniques of proprietar y colleges jeopardized these schools'

access to federal funds. The hearings displayed footage from an undercover investigation showing admissions staff at proprietary schools using recruitment techniques explicitly forbidden by the National Association of College Admissions Counselors. Admissions and enrollment employees are also shown misrepresenting the costs of an education, the graduation and employment rates of students, and the accreditation status of institutions.

Student Loan Settlement

These deceptions increase the likelihood that graduates of for-profits will have special difficulties repaying their loans, since the majority enrolled at these schools are low-income students. (Forbes magazine, Oct. 26, 2010, "When For-Profits Target Low-Income Students", Arnold L. Mitchem)

A credit scoreisnot requiredforfederal loan eligibility. Neither is information regarding income, assets, or employment. Borrowing is still encouraged in the face of strong evidence that the likelihood of default is high.

Loaning money to anyone without prime qualifications was "subprime lending" during the ballooning of the housing bubble, when banks were enticing otherwise ineligible candidates to buy houses they could not afford.

0